Sentiment: Bearish

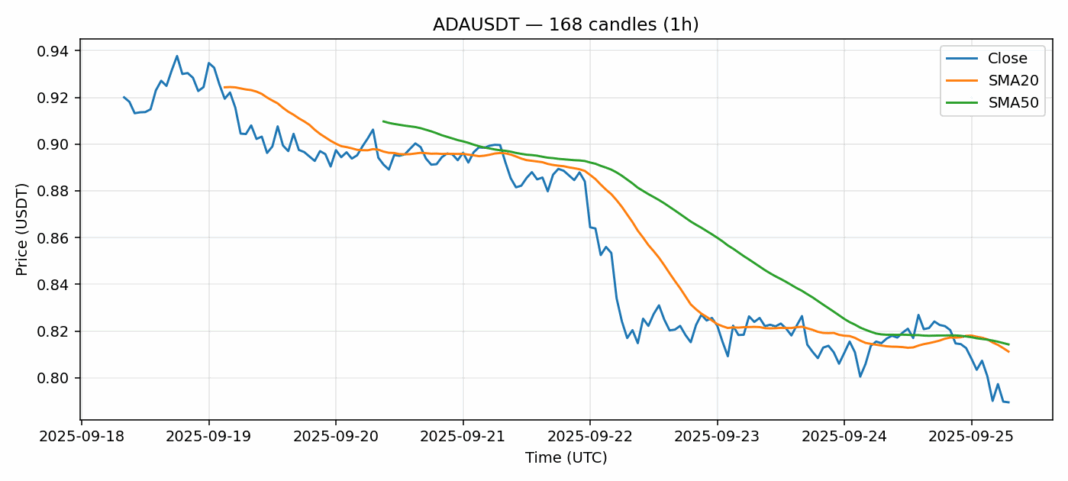

ADA is showing significant weakness with a 3.12% decline to $0.7895, now trading below both its 20-day SMA ($0.811) and 50-day SMA ($0.814). The extremely oversold RSI reading of 19.54 suggests potential for a technical bounce, though such extreme levels can persist during strong downtrends. Volume remains elevated at $87M, indicating sustained selling pressure rather than capitulation. The high volatility reading near 3% reflects the current market uncertainty. Traders should watch for potential support around the $0.78 level – a break below could trigger further downside toward $0.75. For long positions, wait for RSI recovery above 30 and price reclaiming the 20-day SMA. Short-term traders might consider small contrarian longs here with tight stops, while swing traders should remain patient for clearer reversal signals.

Key Metrics

| Price | 0.7895 USDT |

| 24h Change | -3.12% |

| 24h Volume | 87022145.12 |

| RSI(14) | 19.54 |

| SMA20 / SMA50 | 0.81 / 0.81 |

| Daily Volatility | 3.00% |

Cardano — 1h candles, 7D window (SMA20/SMA50, RSI).