Sentiment: Bearish

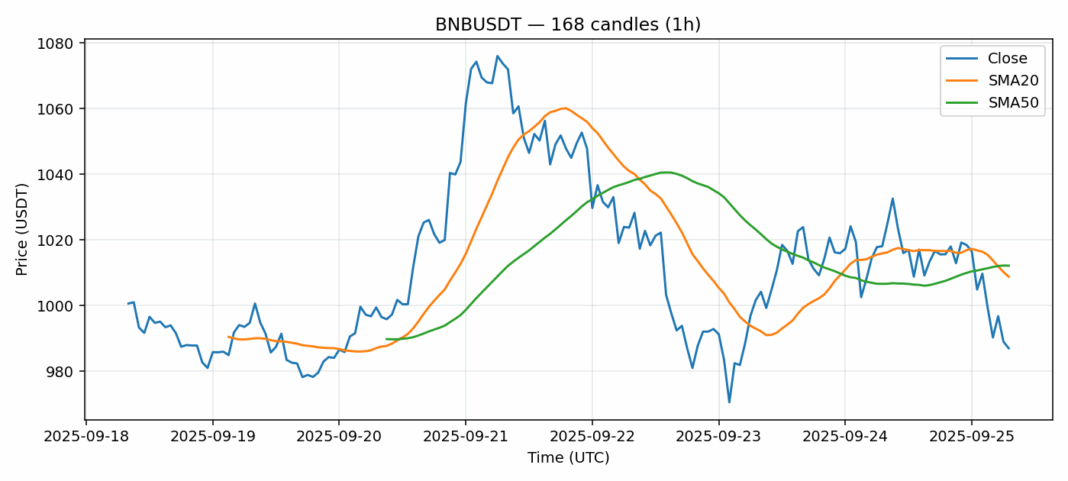

BNB is showing significant weakness, trading at $987 after a nearly 3% decline in the past 24 hours. The price has broken below both the 20-day SMA ($1008) and 50-day SMA ($1012), indicating bearish momentum. The RSI reading of 28.7 suggests BNB is deeply oversold, which typically precedes a potential bounce or consolidation. However, with volatility remaining elevated at nearly 3%, traders should exercise caution. The substantial $388M trading volume indicates strong institutional interest at these levels. Current strategy should focus on waiting for RSI to recover above 30 before considering long positions. Support appears to be forming around $980, while resistance sits at the $1010-1015 zone. Risk management is crucial – consider scaling into positions rather than going all-in at current levels. Wait for confirmation of reversal patterns before committing capital.

Key Metrics

| Price | 987.0200 USDT |

| 24h Change | -2.95% |

| 24h Volume | 388785653.74 |

| RSI(14) | 28.74 |

| SMA20 / SMA50 | 1008.80 / 1012.18 |

| Daily Volatility | 2.97% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).