Sentiment: Bearish

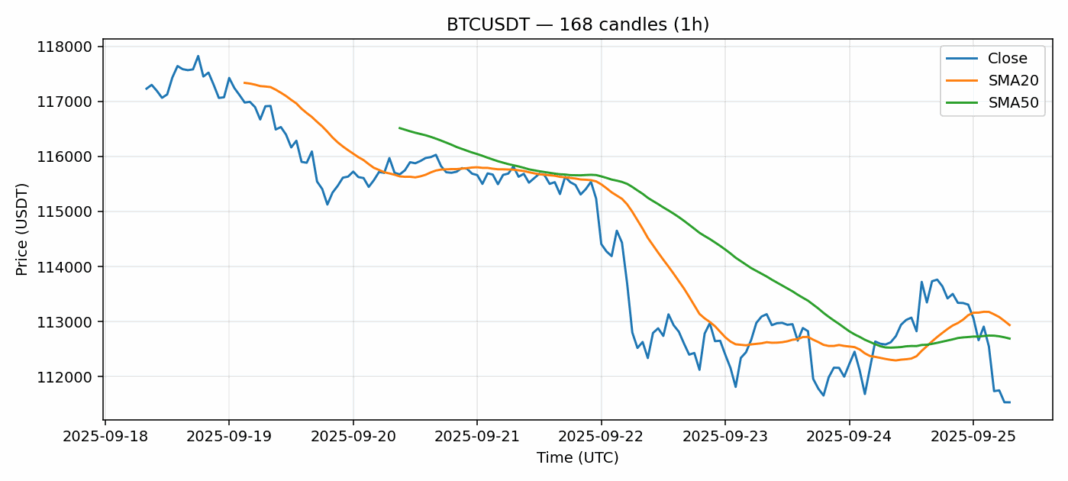

Bitcoin is showing concerning technical signals as it trades at $111,532 with a 0.96% decline over the past 24 hours. The extremely oversold RSI reading of 11.74 suggests potential for a short-term bounce, but also indicates severe selling pressure. Price currently sits below both the 20-day SMA ($112,936) and 50-day SMA ($112,690), confirming the bearish near-term structure. Volume remains substantial at $1.42B, suggesting active participation in this downturn. The volatility reading of 1.12% indicates relatively stable price action despite the downward move. Traders should watch for potential support around $110,000-$111,000 levels. Consider waiting for RSI to recover above 30 before entering long positions. Short-term traders might look for scalping opportunities on any oversold bounces, while longer-term investors could consider dollar-cost averaging into weakness. Risk management remains crucial given the technical breakdown below key moving averages.

Key Metrics

| Price | 111532.8900 USDT |

| 24h Change | -0.96% |

| 24h Volume | 1424151427.76 |

| RSI(14) | 11.74 |

| SMA20 / SMA50 | 112936.39 / 112690.84 |

| Daily Volatility | 1.12% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).