Sentiment: Bearish

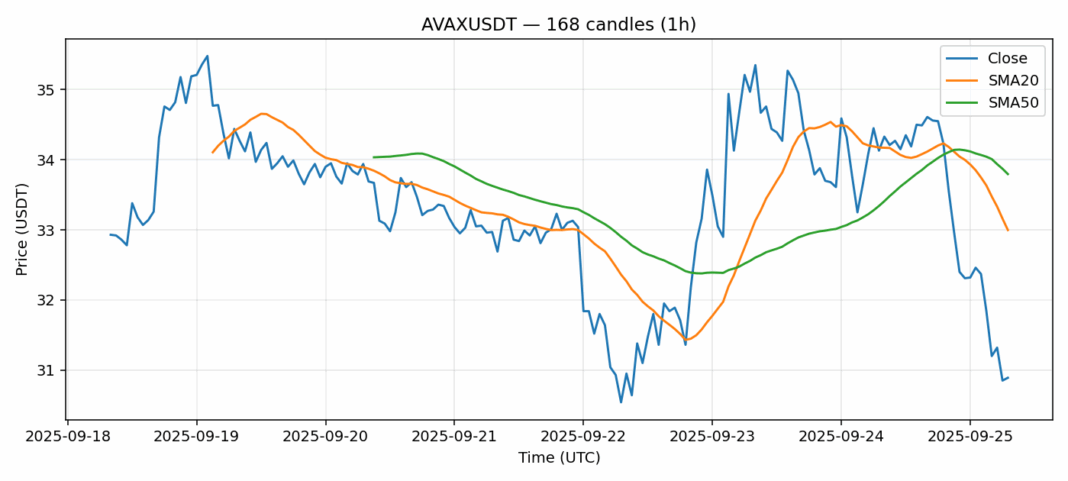

AVAX is showing extreme oversold conditions with an RSI of just 7.23, indicating potential for a sharp relief rally. However, the current price of $30.88 sits below both the 20-day SMA ($32.99) and 50-day SMA ($33.79), confirming the bearish momentum. The 10.3% drop over 24 hours on elevated volume of $161M suggests strong selling pressure, though high volatility at 5.59% could trigger rapid reversals. Traders should watch for consolidation above $30 as a potential bottoming signal. Consider scaling into long positions with tight stops below $29.50, targeting a retest of the 20-day SMA. Avoid aggressive shorts at these levels given the extreme RSI reading. Risk management is crucial amid elevated volatility.

Key Metrics

| Price | 30.8800 USDT |

| 24h Change | -10.31% |

| 24h Volume | 161749416.65 |

| RSI(14) | 7.23 |

| SMA20 / SMA50 | 33.00 / 33.80 |

| Daily Volatility | 5.59% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).