Sentiment: Neutral

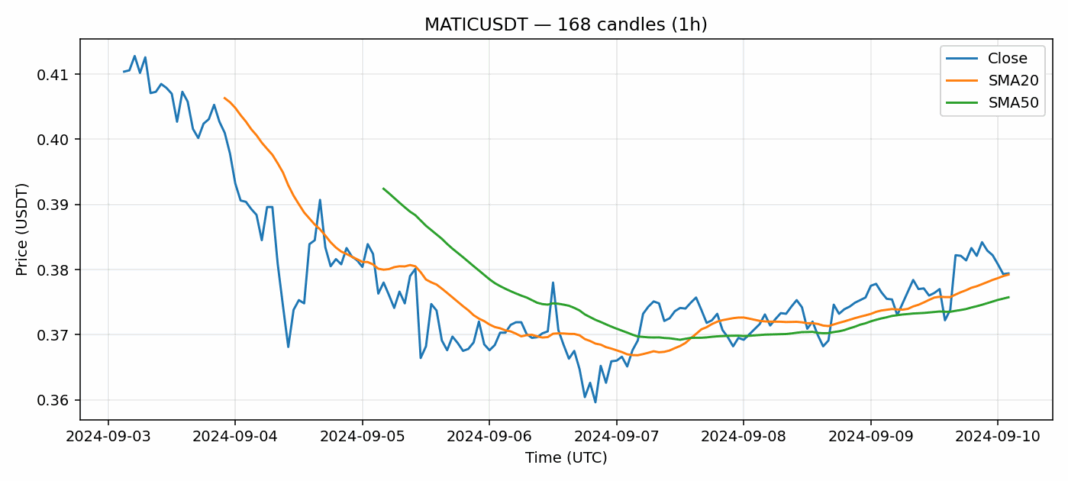

MATIC is showing consolidation around the $0.379 level with minimal deviation from its 20-day SMA ($0.37922), indicating equilibrium between buyers and sellers. The 24-hour decline of 0.289% reflects minor profit-taking rather than structural weakness, especially considering MATIC remains above its 50-day SMA ($0.37573). An RSI of 55.68 suggests neutral momentum with slight bullish bias, while elevated volatility (3.84%) signals potential for directional moves. Trading volume of $1.07M appears adequate but not explosive. Key resistance sits at $0.385-$0.390; sustained breaks could target $0.42. Support holds at the 50-SMA confluence zone near $0.375. Traders should consider accumulating on dips toward $0.375 with stops below $0.368. Scalpers might range-trade between $0.375-$0.385 until volatility expands. Monitor Bitcoin’s momentum for broader market cues.

Key Metrics

| Price | 0.3794 USDT |

| 24h Change | -0.29% |

| 24h Volume | 1074370.70 |

| RSI(14) | 55.68 |

| SMA20 / SMA50 | 0.38 / 0.38 |

| Daily Volatility | 3.84% |

Polygon — 1h candles, 7D window (SMA20/SMA50, RSI).