Sentiment: Bullish

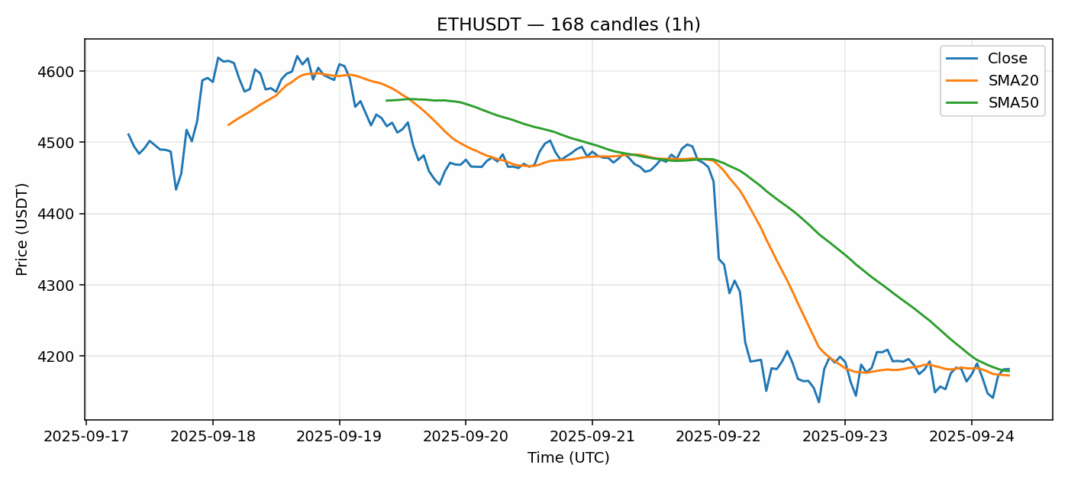

ETH is trading at $4,181, showing slight consolidation after recent volatility. The price is effectively sandwiched between the 20-day SMA ($4,172) and the 50-day SMA ($4,178), indicating a critical inflection point. The RSI at 59.3 leans towards bullish momentum but hasn’t entered overbought territory, leaving room for upward movement. The 24-hour volume of nearly $1.5 billion confirms healthy trader interest, though the minor 0.58% dip suggests some profit-taking. Current volatility of 2.2% is moderate for ETH, typical of a market deciding its next major directional move. My advice is to watch for a decisive break above the $4,200 level, which would signal a run towards $4,300. A failure to hold the 20-day SMA could see a retest of support near $4,100. Use tight stops if entering new long positions here.

Key Metrics

| Price | 4181.7400 USDT |

| 24h Change | -0.58% |

| 24h Volume | 1497724399.52 |

| RSI(14) | 59.30 |

| SMA20 / SMA50 | 4172.73 / 4178.85 |

| Daily Volatility | 2.20% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).