Sentiment: Neutral

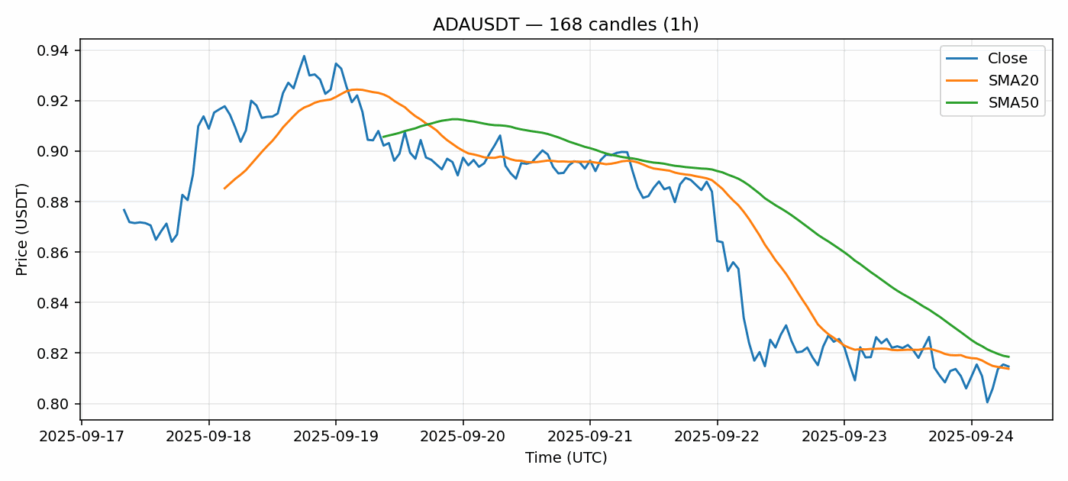

ADA is showing consolidation around the $0.814 level with minimal deviation from its 20-day SMA at $0.8138. The 24-hour performance indicates slight selling pressure with a -1.17% dip, though trading volume remains healthy at $85 million. RSI at 50.42 suggests perfectly balanced momentum without overbought or oversold conditions. The proximity between SMA20 and SMA50 indicates compressed volatility, which often precedes significant directional moves. Current price action is trapped between these moving averages, creating a technical squeeze. Traders should watch for a decisive break above $0.82 (SMA50 resistance) or below $0.81 (SMA20 support) for directional confirmation. Given the low 3.17% volatility reading, position sizing should remain conservative until clearer momentum emerges. Consider accumulating near $0.805 support with stops below $0.795 for swing trades.

Key Metrics

| Price | 0.8147 USDT |

| 24h Change | -1.18% |

| 24h Volume | 85439548.65 |

| RSI(14) | 50.42 |

| SMA20 / SMA50 | 0.81 / 0.82 |

| Daily Volatility | 3.17% |

Cardano — 1h candles, 7D window (SMA20/SMA50, RSI).