Sentiment: Neutral

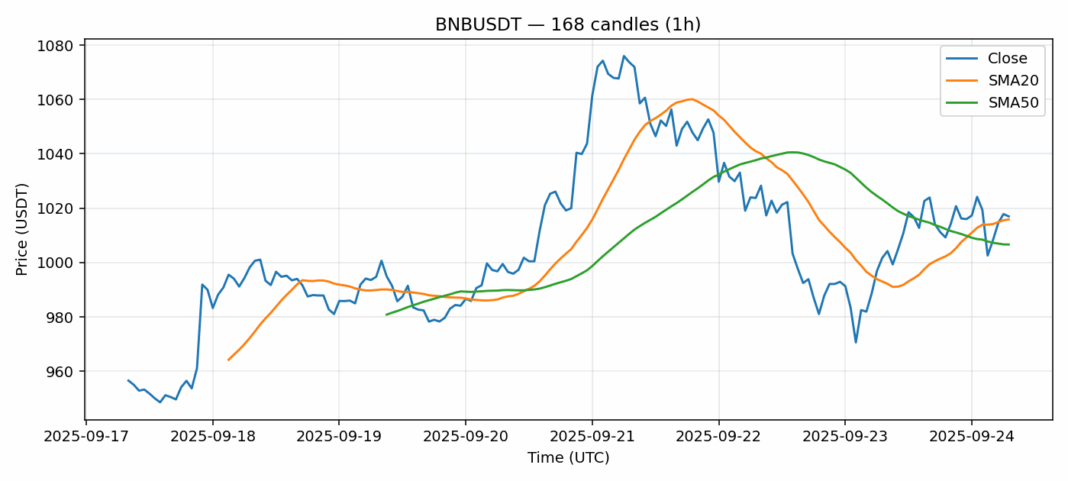

BNB is showing resilience above the $1,000 psychological level, currently trading at $1,016.98 with a modest 2.2% gain over 24 hours. The price is effectively straddling the 20-day SMA ($1,015.85), indicating a critical inflection point, while holding comfortably above the 50-day SMA ($1,006.63), which provides underlying support. The RSI at 52.14 suggests neutral momentum, neither overbought nor oversold, giving room for a directional move. Trading volume of $418 million is healthy but not explosive, suggesting cautious accumulation rather than FOMO-driven buying. The 3% volatility reading points to a relatively stable environment for BNB. My trading advice is to watch for a decisive break and close above the $1,020-$1,025 resistance zone for a potential push towards $1,050. A failure to hold the 50-day SMA would signal weakness, with a likely test of the $980 support level. Use tight stops if entering long positions here.

Key Metrics

| Price | 1016.9800 USDT |

| 24h Change | 2.20% |

| 24h Volume | 417908411.91 |

| RSI(14) | 52.14 |

| SMA20 / SMA50 | 1015.85 / 1006.63 |

| Daily Volatility | 3.03% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).