Sentiment: Bullish

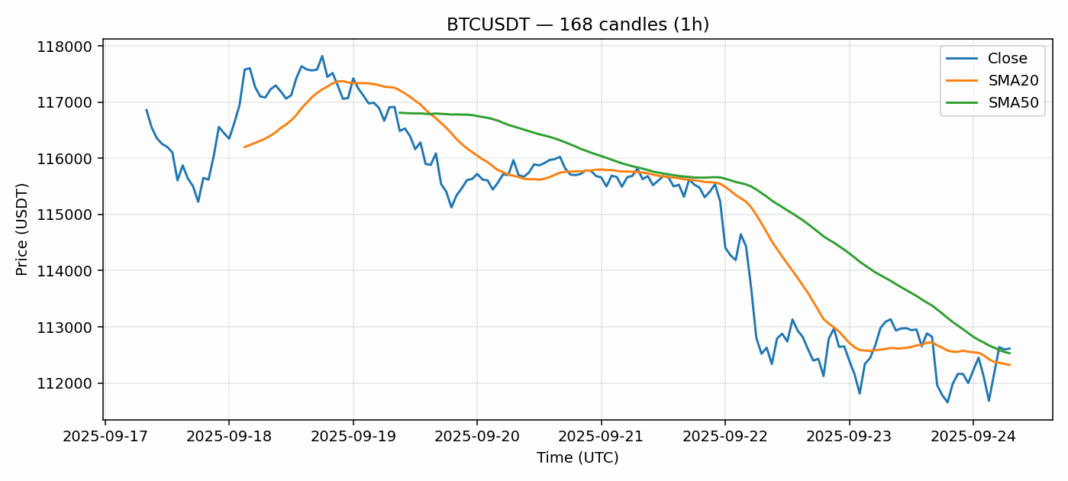

Bitcoin is currently trading at $112,611, showing slight consolidation after a minor 0.32% pullback over 24 hours. The price remains above both the 20-day SMA ($112,322) and 50-day SMA ($112,530), indicating underlying strength despite short-term pressure. With an RSI of 60.21, BTC is approaching overbought territory but still has room for upward movement before hitting extreme levels. The $112,500 level appears to be acting as a key support zone, while resistance sits around $114,000 based on recent price action. Trading volume remains healthy at $1.5 billion, suggesting sustained institutional interest. Traders should consider buying dips toward $112,000 with stops below $111,500, targeting $115,000 for partial profits. The low volatility environment presents opportunities for range trading strategies, though breakout potential remains if Bitcoin can decisively clear $114,000 resistance. Monitor broader market sentiment and ETF flows for directional cues.

Key Metrics

| Price | 112611.3700 USDT |

| 24h Change | -0.32% |

| 24h Volume | 1502126021.11 |

| RSI(14) | 60.21 |

| SMA20 / SMA50 | 112321.70 / 112529.91 |

| Daily Volatility | 1.10% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).