Sentiment: Bullish

DOT is showing resilience around the $4.02 level, trading slightly above its 20-day SMA of $3.99 but facing resistance near the 50-day SMA at $4.12. The 7.45% 24-hour gain on substantial volume of $33.4 million indicates strong buyer interest, likely driven by broader market sentiment or positive ecosystem developments. The RSI at 54.6 is neutral, suggesting room for movement in either direction without immediate overbought or oversold pressure. Current price action suggests a consolidation phase between $3.95 and $4.15. A decisive break above the 50-day SMA with sustained volume could target $4.30-$4.50. Traders should set tight stops below $3.95 and consider scaling into long positions on pullbacks toward the 20-day SMA support. Monitor Polkadot parachain auction news closely as it remains a key price catalyst.

Key Metrics

| Price | 4.0190 USDT |

| 24h Change | 0.30% |

| 24h Volume | 33486902.91 |

| RSI(14) | 54.59 |

| SMA20 / SMA50 | 4.00 / 4.12 |

| Daily Volatility | 4.06% |

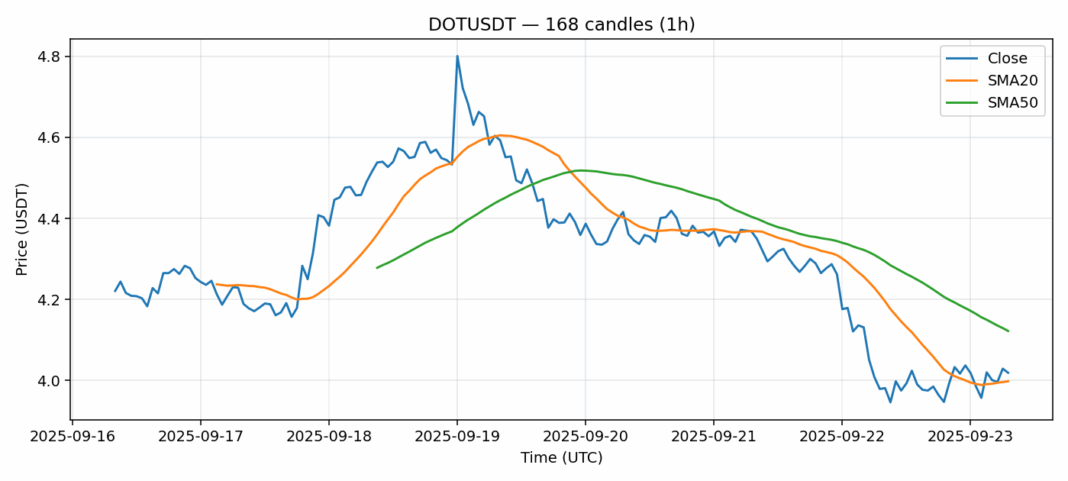

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).