Sentiment: Neutral

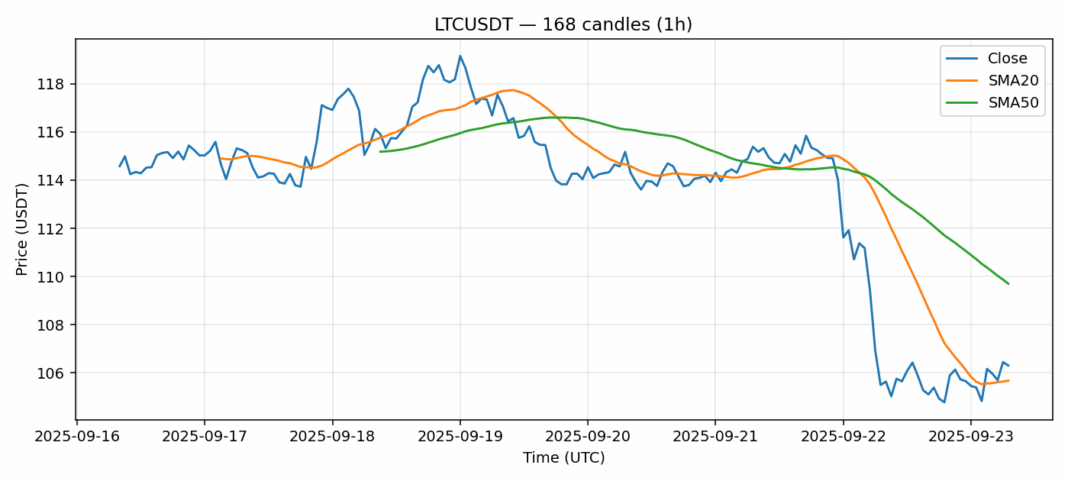

LTCUSDT is showing mixed signals at $106.30, trading slightly above its 20-day SMA ($105.67) but below the 50-day SMA ($109.70), indicating near-term consolidation with underlying weakness. The 24-hour decline of -0.375% on substantial volume (~$48M) suggests active distribution. RSI at 57.7 leans neutral-bullish but lacks strong momentum. Current price action appears range-bound between the SMAs, with volatility at 2.56% reflecting moderate uncertainty. Traders should watch for a decisive break above $110 for bullish confirmation or a drop below $105 for bearish continuation. Short-term: consider limit orders near $104-105 support for scalps. Medium-term: wait for clearer trend confirmation—either a SMA crossover or volume-backed breakout. Risk management is key given Litecoin’s sensitivity to Bitcoin movements.

Key Metrics

| Price | 106.3000 USDT |

| 24h Change | -0.38% |

| 24h Volume | 48141969.89 |

| RSI(14) | 57.69 |

| SMA20 / SMA50 | 105.67 / 109.70 |

| Daily Volatility | 2.56% |

Litecoin — 1h candles, 7D window (SMA20/SMA50, RSI).