Sentiment: Neutral

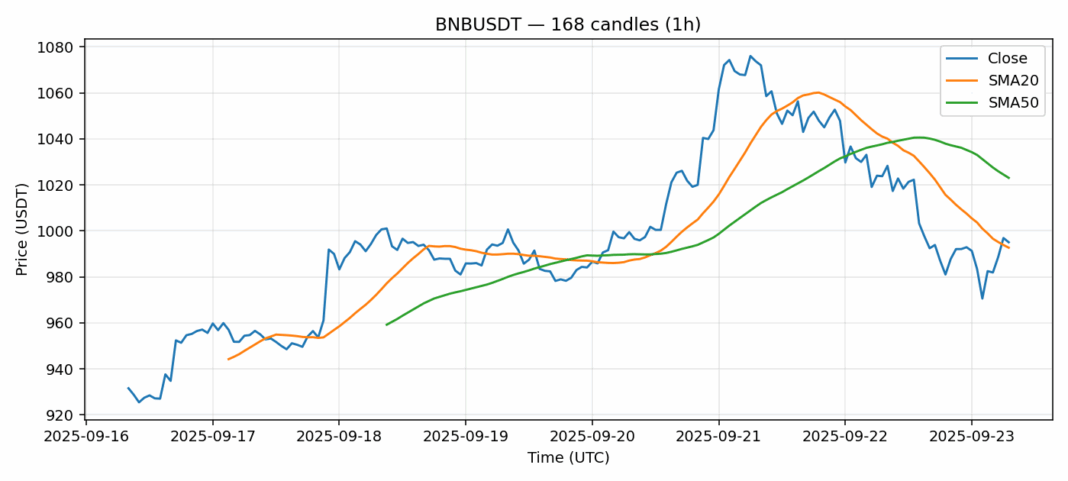

BNB is currently trading at $995.05, showing slight weakness with a 2.6% decline over the past 24 hours. The price is hovering just above the 20-day SMA at $992.70, indicating near-term support, but remains below the 50-day SMA at $1,023.05, suggesting medium-term resistance. The RSI at 50.77 is perfectly neutral, reflecting balanced momentum without clear overbought or oversold conditions. Daily volume of $474 million is decent but not explosive. Given the tight range between the SMAs and moderate volatility around 3%, BNB appears to be consolidating. Traders should watch for a decisive break above $1,025 for bullish confirmation or a drop below $985 for bearish momentum. Consider range-bound strategies until a clearer trend emerges, with tight stop-losses.

Key Metrics

| Price | 995.0500 USDT |

| 24h Change | -2.60% |

| 24h Volume | 474359395.55 |

| RSI(14) | 50.77 |

| SMA20 / SMA50 | 992.70 / 1023.05 |

| Daily Volatility | 2.96% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).