Sentiment: Bullish

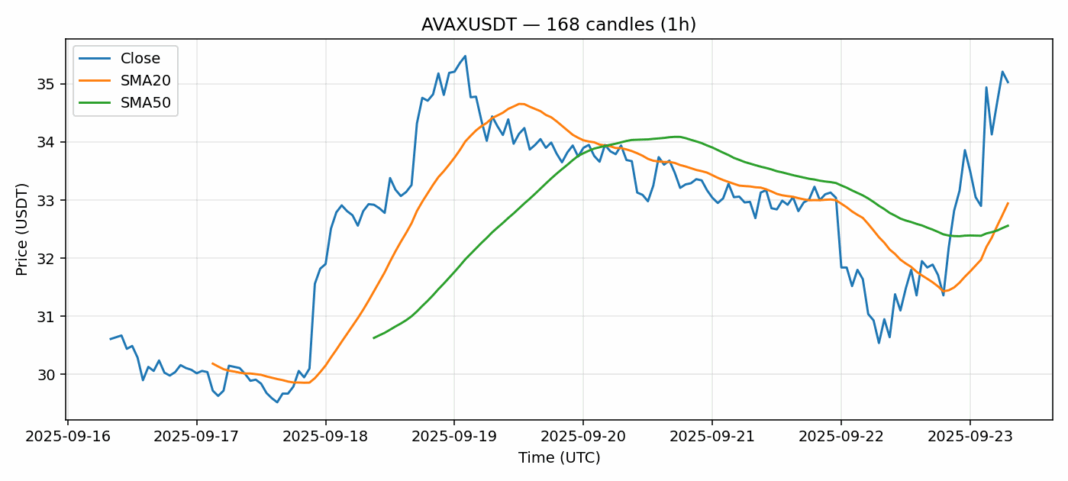

AVAX is showing strong momentum with a 13% surge to $35.03, decisively breaking above both the 20-day SMA ($32.94) and 50-day SMA ($32.56). This indicates a robust bullish trend is in place. The RSI reading of 69.38 is approaching overbought territory but hasn’t crossed the critical 70 threshold yet, suggesting there’s still room for upward movement before a potential pullback. The substantial 24-hour volume of over $307 million confirms strong institutional and retail interest driving this rally. Traders should consider entering long positions with a tight stop-loss below the $32.50 support level, targeting initial resistance around $38. However, the elevated volatility of 5.29% warrants caution – consider taking partial profits on the way up. The key will be whether AVAX can consolidate above the $34 support zone to build a new base for the next leg higher.

Key Metrics

| Price | 35.0300 USDT |

| 24h Change | 13.07% |

| 24h Volume | 307582157.96 |

| RSI(14) | 69.38 |

| SMA20 / SMA50 | 32.94 / 32.56 |

| Daily Volatility | 5.29% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).