Sentiment: Neutral

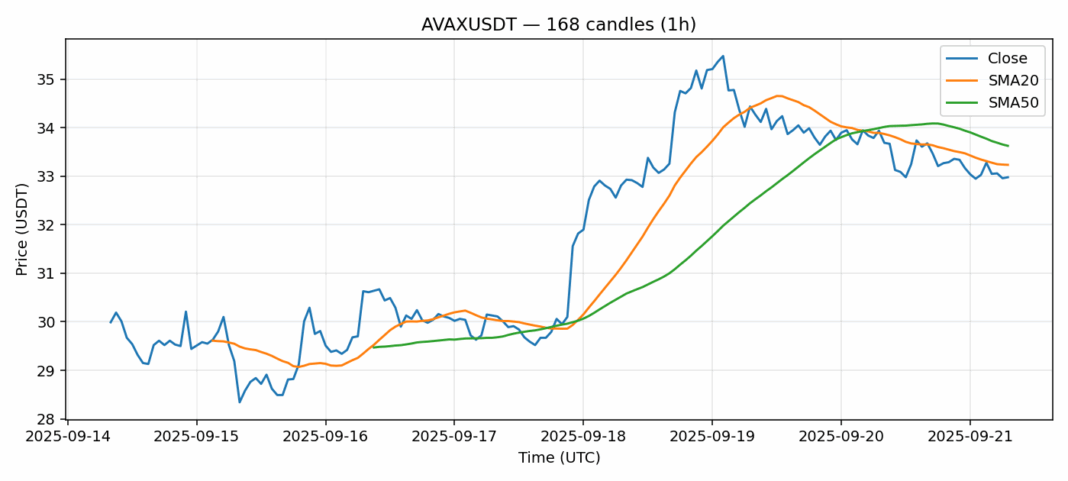

AVAXUSDT is currently trading at $32.98, showing a 24-hour decline of 2.43% amid elevated volatility of 4.59%. The RSI reading of 33.77 indicates oversold conditions, suggesting potential for a near-term bounce. Price is trading slightly below the 20-day SMA ($33.24) and the 50-day SMA ($33.63), indicating short-term bearish pressure but with key support levels nearby. The 24-hour volume of $96.8 million shows decent participation. Given the oversold RSI and proximity to moving averages, I’d watch for a potential reversal around the $32.50-$33.00 zone. Consider scaling into long positions with tight stops below $32.00, targeting a move back toward $34.50-$35.00 resistance. Risk management is crucial given the current volatility environment.

Key Metrics

| Price | 32.9800 USDT |

| 24h Change | -2.43% |

| 24h Volume | 96785364.06 |

| RSI(14) | 33.77 |

| SMA20 / SMA50 | 33.24 / 33.63 |

| Daily Volatility | 4.59% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).