Sentiment: Neutral

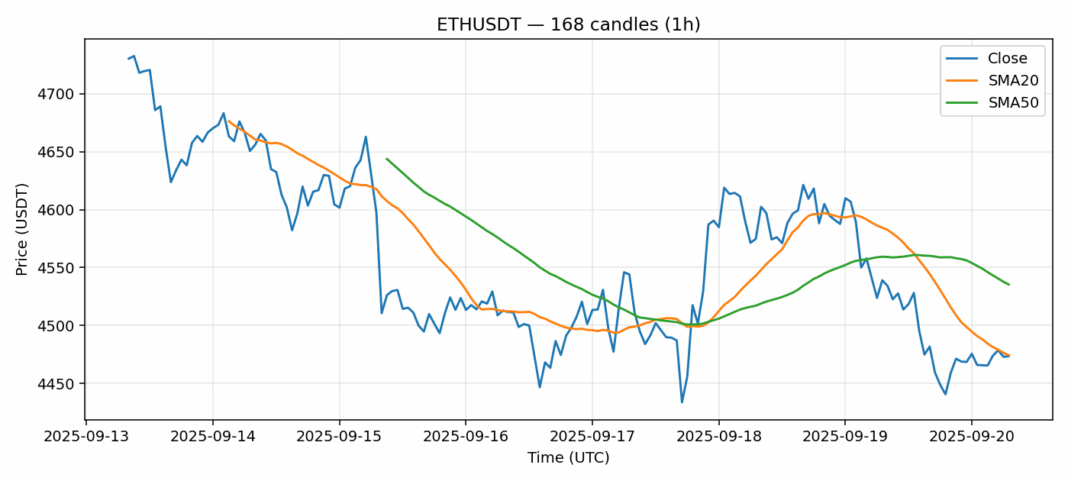

ETH is currently trading at $4,473.52, showing a slight 24-hour decline of -1.14%. The price is hovering right around the 20-day SMA at $4,474.43, indicating a critical technical juncture. While the RSI at 57.89 is in neutral territory, it suggests there’s room for movement in either direction before becoming overbought. The 24-hour volume of over $1.24 billion shows healthy market participation. The key resistance to watch is the 50-day SMA at $4,535.42; a decisive break above this level could signal renewed bullish momentum. Given the current consolidation near the 20-day SMA, I recommend waiting for a clear directional break before entering new positions. Tight stop-losses are advised due to the 1.97% volatility reading. Consider scaling into long positions only if ETH can reclaim the $4,535 level with conviction.

Key Metrics

| Price | 4473.5200 USDT |

| 24h Change | -1.14% |

| 24h Volume | 1244432101.27 |

| RSI(14) | 57.89 |

| SMA20 / SMA50 | 4474.43 / 4535.42 |

| Daily Volatility | 1.97% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).