Sentiment: Bullish

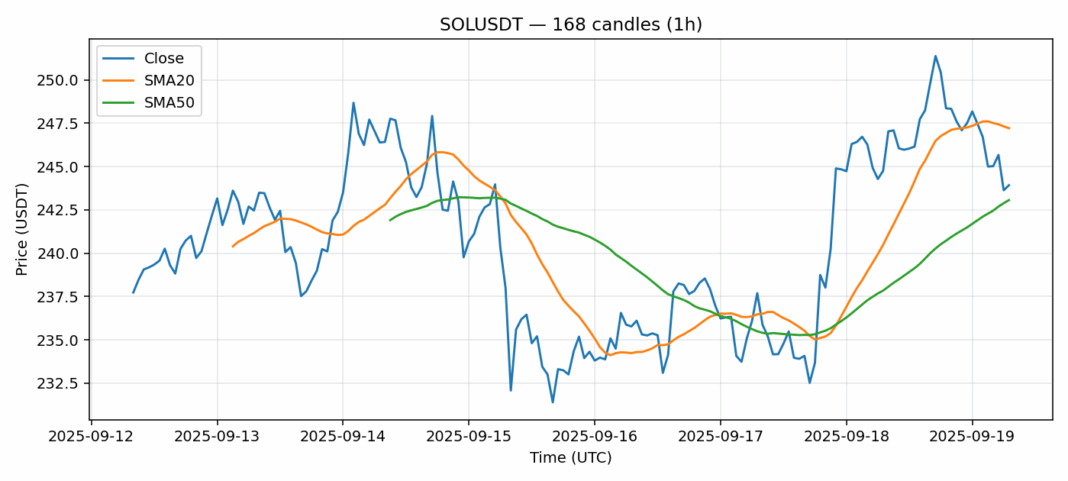

SOLUSDT is currently trading at $243.92, showing a slight 24-hour decline of -0.196%. The RSI reading of 17.73 indicates severely oversold conditions, which historically presents potential buying opportunities. Price is trading just below the 20-day SMA ($247.21) but above the 50-day SMA ($243.06), suggesting near-term consolidation with underlying strength. The 24-hour volume of $925M demonstrates healthy liquidity, while volatility remains moderate at 2.88%. Given the extreme oversold RSI and price holding above key moving averages, I recommend accumulating positions on any dips below $240. Set stop losses around $235 and target resistance levels at $250-255. The current setup favors long positions with careful risk management.

Key Metrics

| Price | 243.9200 USDT |

| 24h Change | -0.20% |

| 24h Volume | 925434446.05 |

| RSI(14) | 17.73 |

| SMA20 / SMA50 | 247.21 / 243.06 |

| Daily Volatility | 2.88% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).