Sentiment: Neutral

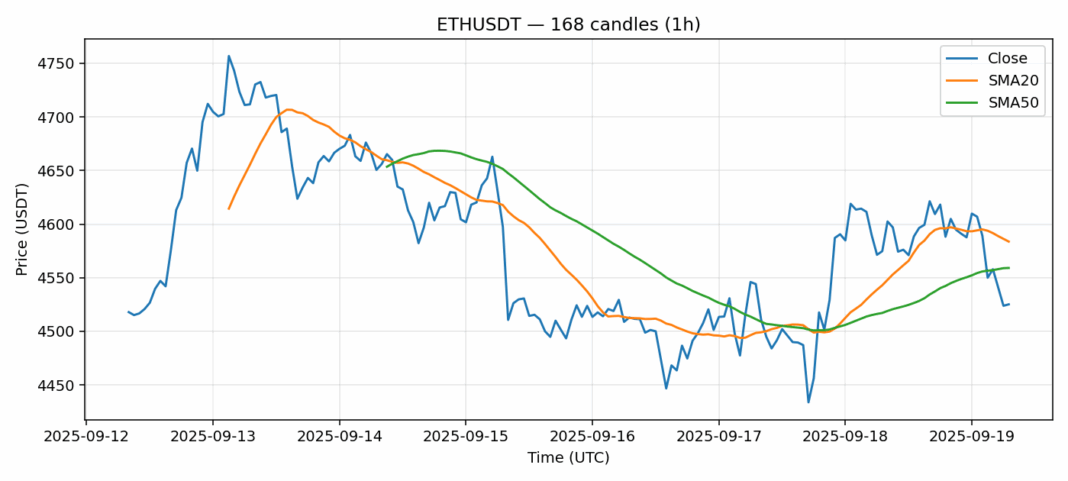

ETH is currently trading at $4,525, showing a slight 24-hour decline of 1.05% amid elevated volatility of 2.09%. The RSI reading of 28.7 indicates ETH is deeply oversold, typically suggesting potential for a near-term bounce. Price is trading below both the 20-day SMA ($4,584) and 50-day SMA ($4,559), confirming short-term bearish momentum. However, the oversold conditions combined with strong volume of $1.25B suggest we might be approaching a local bottom. Traders should watch for a potential reversal around the $4,450-$4,500 support zone. Consider scaling into long positions with tight stops below $4,400, targeting a retest of the $4,600 resistance level. Risk management is crucial given the current volatility environment.

Key Metrics

| Price | 4525.1400 USDT |

| 24h Change | -1.05% |

| 24h Volume | 1249870307.88 |

| RSI(14) | 28.73 |

| SMA20 / SMA50 | 4583.70 / 4559.10 |

| Daily Volatility | 2.09% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).