Sentiment: Bullish

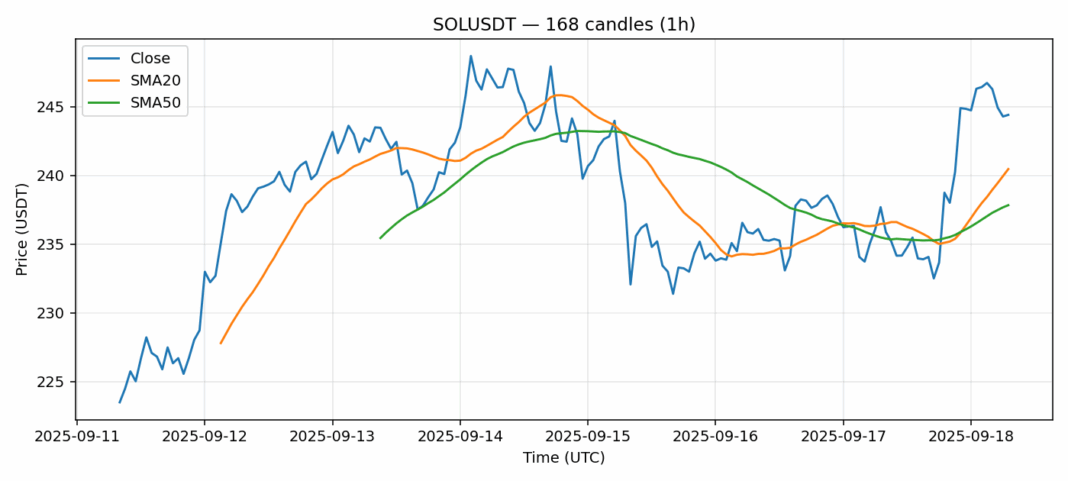

SOLUSDT is currently trading at $244.4, showing a healthy 24-hour gain of 3.59% with substantial volume exceeding $1.2 billion. The RSI reading of 82 indicates the asset is heavily overbought, suggesting potential near-term pullback risk. However, price remains above both the 20-day SMA ($240.46) and 50-day SMA ($237.83), maintaining bullish momentum structure. The 2.99% volatility suggests moderate price swings are expected. Given the overbought conditions, I’d recommend taking partial profits here and waiting for a dip toward the $235-240 support zone before adding more exposure. Use tight stop-losses below $235 if holding current positions, as a rejection from these levels could trigger a 5-8% correction. Overall trend remains upward but requires careful risk management at these elevated levels.

Key Metrics

| Price | 244.4000 USDT |

| 24h Change | 3.59% |

| 24h Volume | 1200978233.91 |

| RSI(14) | 82.05 |

| SMA20 / SMA50 | 240.46 / 237.83 |

| Daily Volatility | 2.99% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).