Sentiment: Bullish

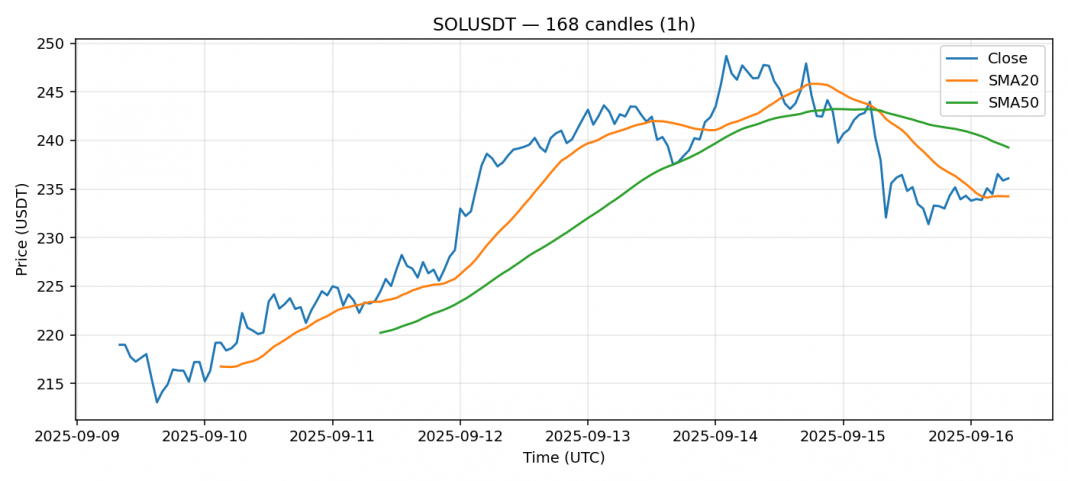

SOL is currently trading at $236.10, showing a slight 24-hour decline of -1.87% but maintaining position above the 20-day SMA at $234.24. The RSI reading of 64.52 indicates bullish momentum without being overbought, suggesting room for upward movement. Trading volume remains robust at over $1 billion, indicating sustained market interest. While price sits slightly below the 50-day SMA at $239.28, the narrow gap suggests potential for a breakout. Volatility at 2.96% is moderate for SOL. Current setup favors accumulation on any dips toward $230 support. Target resistance at $245-250 range. Maintain stop-loss below $225 to manage downside risk. The overall technical picture suggests consolidation before potential upward movement.

Key Metrics

| Price | 236.1000 USDT |

| 24h Change | -1.87% |

| 24h Volume | 1096542415.14 |

| RSI(14) | 64.52 |

| SMA20 / SMA50 | 234.24 / 239.28 |

| Daily Volatility | 2.96% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).