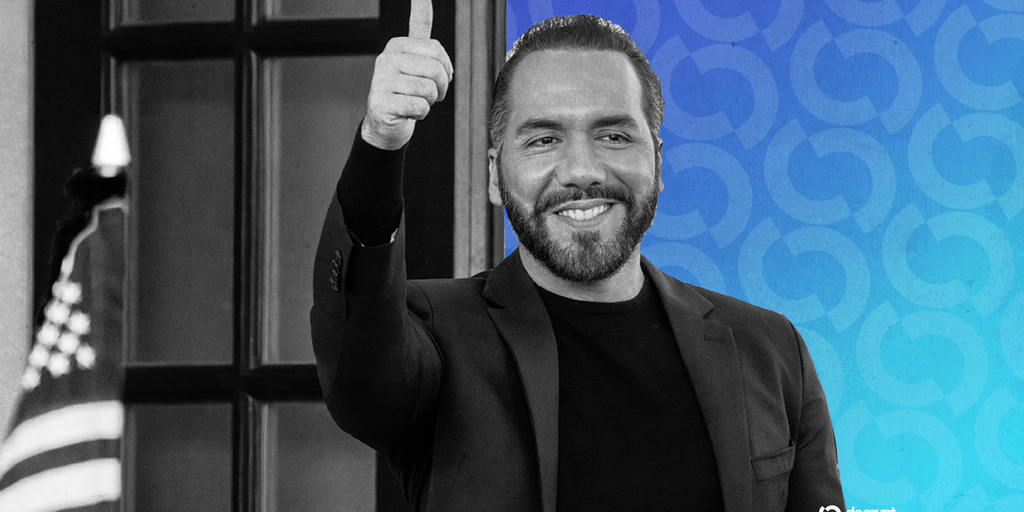

A notable discrepancy has emerged between the International Monetary Fund (IMF) and El Salvador regarding the nation’s Bitcoin acquisition strategy. The IMF recently asserted that El Salvador has halted further purchases of the cryptocurrency, contradicting public statements from President Nayib Bukele, a prominent Bitcoin advocate. Bukele has consistently maintained that the country is systematically acquiring one Bitcoin daily.

This divergence highlights a significant communication gap or a potential misinterpretation of the nation’s fiscal activities. The IMF’s position likely stems from its macroeconomic assessments and official data reviews, which may not account for or verify the decentralized and pseudonymous nature of these small-scale, daily transactions. Conversely, President Bukele’s announcements are viewed by supporters as a transparent commitment to his long-term digital asset strategy.

The situation underscores the broader challenges international financial institutions face when monitoring and evaluating the integration of cryptocurrencies into national treasuries. It also raises questions about the verification mechanisms for such government-led crypto operations. The outcome of this disagreement could influence future dialogues between sovereign nations adopting digital currencies and global regulatory bodies seeking to maintain traditional economic oversight.