Sentiment: Bullish

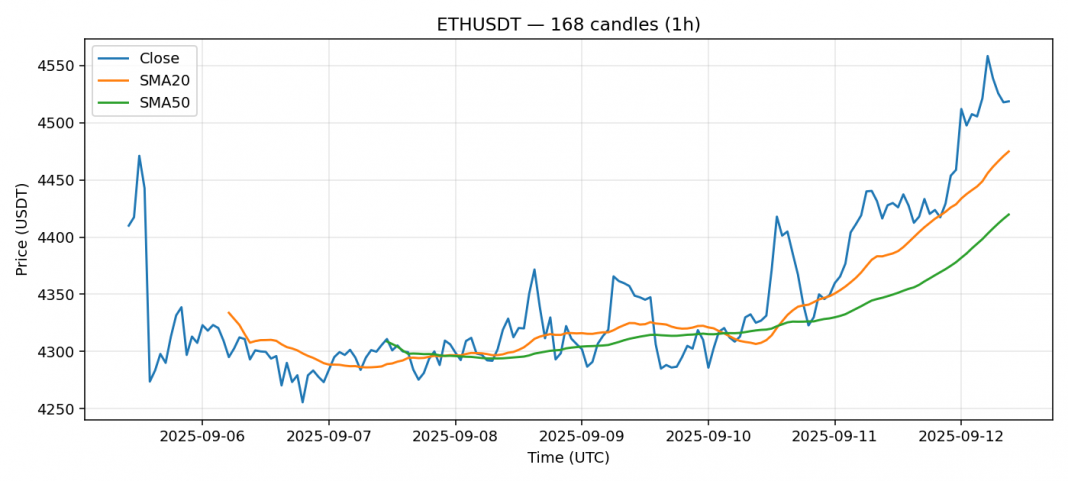

ETH is showing strength, trading above both the 20 and 50-day SMAs with a 2.27% gain on solid volume. The RSI at 71.4 indicates overbought conditions, suggesting potential for a near-term pullback or consolidation. However, the momentum remains positive as price holds above key moving averages. Volatility is elevated at 2.32%, typical for crypto but requiring careful position sizing. Traders should consider taking partial profits here or setting tight stop-losses below $4,474 (SMA20) for long positions. Wait for a dip toward $4,420 (SMA50) for better risk-reward entries if bullish momentum continues. Monitor volume closely—sustained high volume could push through resistance, while declining volume may signal a reversal.

Key Metrics

| Price | 4518.7300 USDT |

| 24h Change | 2.27% |

| 24h Volume | 2141515055.07 |

| RSI(14) | 71.42 |

| SMA20 / SMA50 | 4474.91 / 4419.74 |

| Daily Volatility | 2.32% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).