Sentiment: Bullish

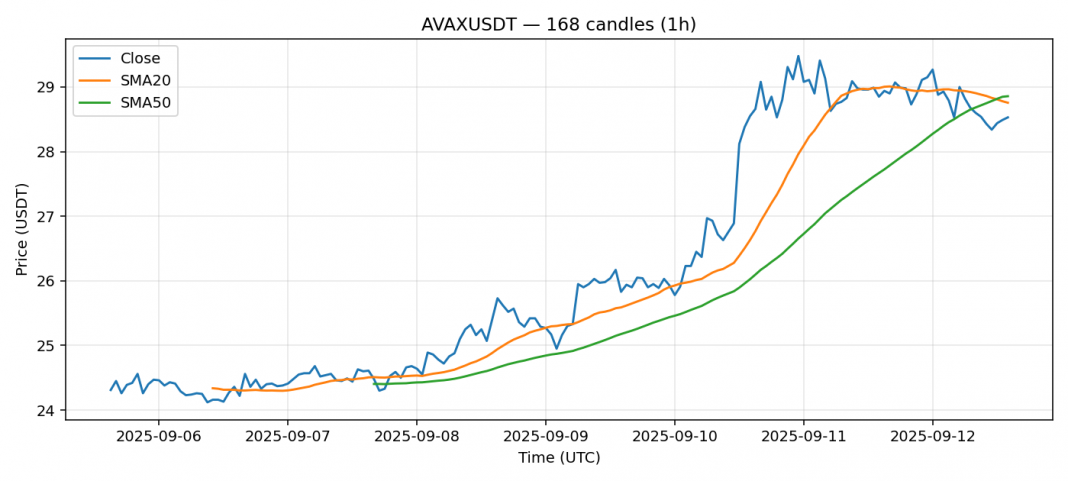

AVAX is currently trading at $28.53, showing a slight decline of 1.1% over the past 24 hours. The RSI reading of 32.87 indicates the asset is approaching oversold territory, which often presents potential buying opportunities for swing traders. Price is trading slightly below both the 20-day SMA ($28.76) and 50-day SMA ($28.86), suggesting near-term bearish pressure but with strong support levels nearby. The 24-hour volume of $89 million demonstrates healthy liquidity, while the 3.69% volatility indicates moderate price swings. Given the oversold RSI and proximity to key moving averages, I recommend considering accumulation near current levels with a stop below $27.50. Target resistance levels at $30.50 and $32.00 for partial profit-taking.

Key Metrics

| Price | 28.5300 USDT |

| 24h Change | -1.11% |

| 24h Volume | 89075048.91 |

| RSI(14) | 32.87 |

| SMA20 / SMA50 | 28.76 / 28.86 |

| Daily Volatility | 3.69% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).