Sentiment: Bullish

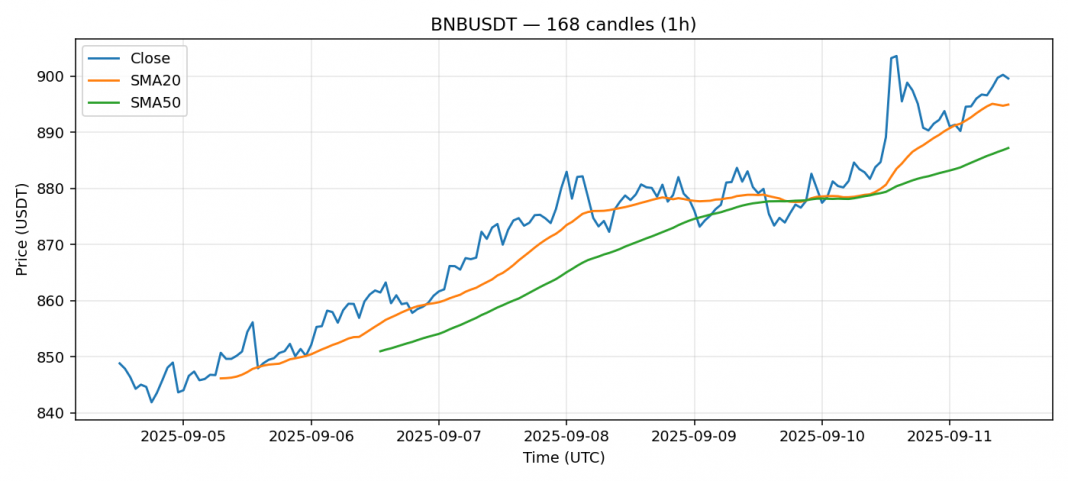

BNB is showing strength, trading at $899.58 with a solid 1.7% gain over the past 24 hours. The price is currently above both the 20-day SMA ($894.93) and 50-day SMA ($887.19), indicating a bullish near-term trend. However, the RSI reading of 73.09 suggests the asset is approaching overbought territory, which could signal a potential pullback or consolidation in the short term. Volume remains healthy at $279M, supporting the current price action. Given the elevated RSI and moderate volatility of 1.37%, I’d advise caution on new long positions at these levels. Wait for a dip toward the $890 support zone or a break above $905 with volume confirmation before adding exposure. Consider taking partial profits if holding from lower levels.

Key Metrics

| Price | 899.5800 USDT |

| 24h Change | 1.71% |

| 24h Volume | 279029997.42 |

| RSI(14) | 73.09 |

| SMA20 / SMA50 | 894.93 / 887.19 |

| Daily Volatility | 1.37% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).